Not known Factual Statements About Can I File Bankruptcy More Than Once in VA?

you compensated at the least 70% of your statements inside the Chapter 13 case, and you simply proposed the system in excellent faith and employed your very best exertion to repay creditors.

Conference with a credit score counselor may well turn out currently being needed in any case, as any one filing for bankruptcy is needed to obtain credit history counseling from a federal government-authorized company as A part of the procedure.

When your discharge was denied, you might be able to file all over again but possible will not be eligible for any discharge of the specific debts that were denied a discharge inside your initial case.

Once the procedure commences, a court docket-authorized debt repayment system is ready up and adopted about 3 to five years.

Furthermore, You will find a needed waiting around time just after every petition – depending upon the bankruptcy chapter – before you could possibly file for another bankruptcy.

A credit rating counselor may help Appraise your latest economical situation and figure out no matter if bankruptcy is the greatest class of motion.

Bank cards and banking professional Jenn Underwood delivers around 16 a long time of private finance encounter for the table. Soon after a decade of teaching courses in banking, financial debt reduction, budgeting and credit score improvement, she moved into composing information and fintech product progress.

Throughout the last 4 years, Jenn has contributed to Forbes Advisor and several different fintech providers. She has served for a UX marketing consultant, moderated conversations on open banking and been a visitor on a variety of personal finance podcasts.

You’ll have to fill out some prolonged forms whenever you file Related Site for bankruptcy. They’re precisely the same it does not matter where you reside, and you'll down load them as fillable PDFs without spending a dime at USCOURTS.gov. Follow the comprehensive Directions for filling them out and be sure to don’t miss out on any types.

If, Alternatively, your debts weren't discharged and click this site the courtroom dismissed your scenario, distinctive procedures utilize. Should the bankruptcy court docket dismisses your circumstance with prejudice, you could be prohibited from filing One more bankruptcy for one hundred eighty days.

For those who’re driving on payments or your automobile is well worth fewer than what you still owe on it, visit this site you will be much better off surrendering the vehicle. In the event you do that, you received’t really need to make any more every month payments on it. Another option is to pay for the lender the car’s latest benefit in one lump sum.

Not submitting the proper files. Lots of bankruptcy click here for more info filers who dont use a lawyer that can help them dont file most of the expected bankruptcy files. If this problem isn't fixed, the courtroom will dismiss the case.

Objections to discharge. Although unsecured financial debt can typically be discharged in a very chapter 7 circumstance, that isn't normally the case. If a bank card company objects to your discharge of what continues to be termed binge financial debt a choose could get which the debtor still have to repay some or all of the quantity owed.

This stuff must take place prior important site to deciding to obtain a Chapter seven bankruptcy discharge. Chapter thirteen filers can even go to a repayment approach affirmation Listening to and total the 3- to 5-year payment program.

Luke Perry Then & Now!

Luke Perry Then & Now! Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Michelle Pfeiffer Then & Now!

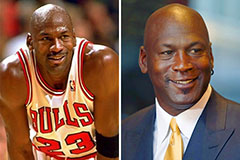

Michelle Pfeiffer Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now!